Credit Unions 2025: Unlock the Power of Data and AI

- Anne Legg

- Nov 21, 2024

- 3 min read

Updated: Dec 17, 2024

Data and artificial intelligence (AI) are no longer just tools, they are table stakes! They are the strategic levers poised to elevate growth, streamline efficiencies, deepen intelligence, and empower members like never before. The question is no longer if credit unions should embrace these innovations but how they can maximize their potential.

Here are key areas credit unions should focus on in 2025 to effectively leverage the power of data and AI.

1. Growth: Personalization at Scale

Data is the lifeblood of personalization, and AI is the engine driving it. In 2025, credit unions have an opportunity to harness their data to create hyper-personalized member experiences. Imagine tailoring financial advice, loan offers, or savings plans for each member based on their unique behaviors and needs.

AI can analyze spending patterns, predict future needs, and suggest solutions proactively. Credit unions investing in AI-driven personalization will deepen member relationships and attract new ones seeking a financial partner who “gets” them.

2. Efficiency: Doing More with Less

With tightening margins and increasing competition, operational efficiency is a top priority. AI and advanced analytics offer solutions to streamline back-office operations, optimize resource allocation, and improve workflows.

Consider using AI to automate routine tasks, such as fraud detection or loan approvals, freeing your team to focus on higher-value activities. AI can also identify department inefficiencies, providing actionable insights to cut costs and boost productivity without sacrificing quality.

3. Intelligence: Real-Time Decision Making

Data is most valuable when it’s actionable. In 2025, credit unions must shift from retrospective analysis to real-time intelligence. AI-driven tools like predictive analytics and machine learning can empower leaders to make decisions faster and more confidently.

For example, credit unions can use real-time data to monitor economic trends, adjust risk models, or identify emerging opportunities in member behaviors. This agility strengthens decision-making and positions credit unions as proactive problem-solvers.

4. Empowerment: Data as a Member Asset

In 2025, data will evolve from an internal resource to a member-facing value proposition. Credit unions that empower their members with actionable insights—like budgeting tools, spending trends, and financial forecasts—will enhance loyalty and trust.

AI can enable members to visualize their financial health, set goals, and receive personalized advice in an intuitive, digestible format. By becoming their members’ trusted financial guide, credit unions will strengthen their competitive edge against fintech disruptors.

5. Ethical AI and Data Governance

With great power comes great responsibility. As credit unions explore AI further, ethical considerations must remain at the forefront. Members trust credit unions to safeguard their data, and that trust is priceless. Data governance frameworks and AI ethics policies will be essential in 2025. Transparent practices, bias-free algorithms, and robust cybersecurity measures will protect members and position credit unions as industry leaders in responsible innovation.

Preparing for What’s Next

2025 will not be about adopting every shiny new AI tool but rather strategically aligning data and AI initiatives with the credit union’s mission. Here’s how to start:

Assess Your Data Readiness: Conduct a thorough audit of your current data capabilities and identify gaps.

Build AI Expertise: Invest in training and tools to upskill your team and foster a culture of innovation.

Focus on Quick Wins: Start with small, impactful projects demonstrating data and AI's value.

Engage Your Members: Use their feedback to co-create solutions that resonate with their needs.

The year ahead holds unparalleled potential for credit unions to redefine member impact. By leveraging data and AI strategically, you won’t just keep pace with change—you’ll lead it.

Let’s make 2025 the year of intentional innovation. Together, we can build a future where data and AI empower credit unions to improve lives, one member at a time.

Have you visited the Quick Start 2025 Guide?

To help credit unions plan for a year of growth efficiency, intelligence, and empowerment, THRIVE has curated this guide to provide your credit union with resources to give you a head start on the new year. This guide brings actionable insight and tools in the following three critical areas. Click an image to learn more!

Ready to explore the future of your credit union?

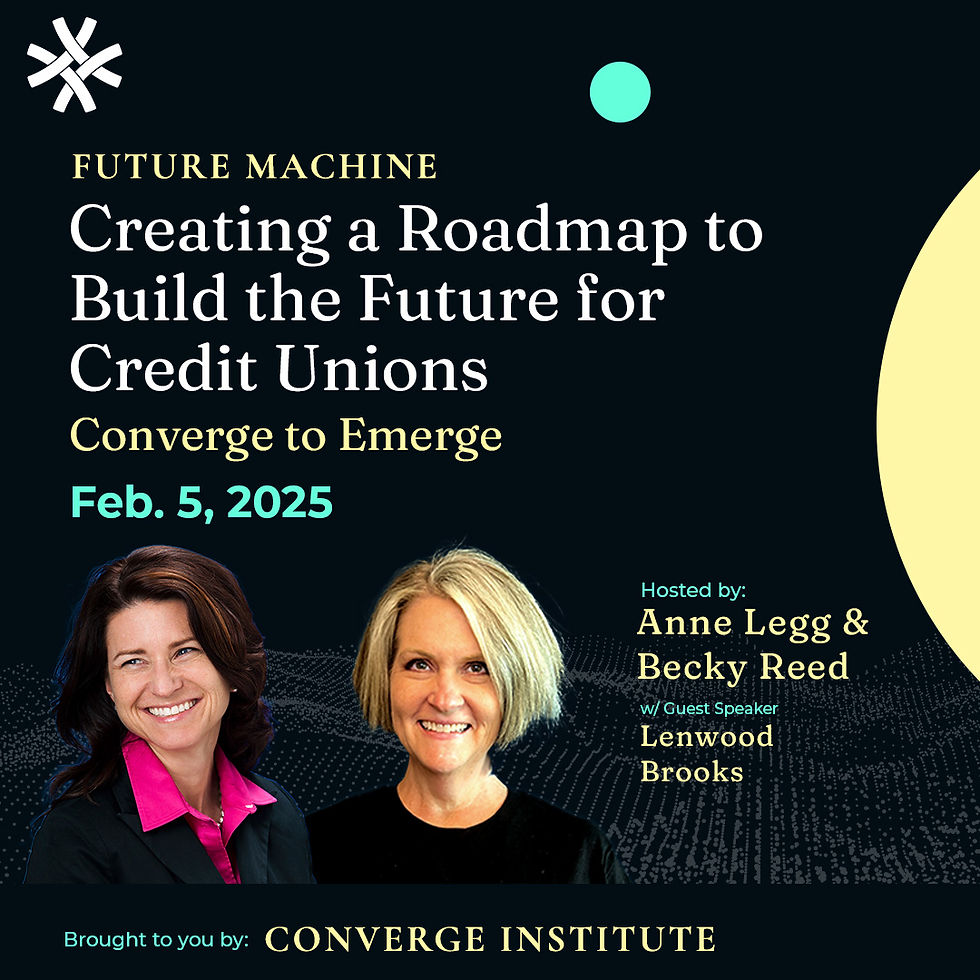

Join us at the Future Machine Workshop to unlock forward-thinking solutions for tomorrow's challenges while staying on track with your goals today!

2025 is here!

Is your Data ready to leverage AI?

While 85% of decision-makers agree that quality data is vital for AI success, only 34% believe in the accuracy and integrity of their data.

We are here to help! Unlock your credit union’s data potential with our 2025 Data Mastery Bundle, which combines the Data Activation Master Class and Deep Dive Data Governance Program. You will gain comprehensive insights into leveraging data for growth, efficiency, intelligence, and empowerment!

Master your data and transform your credit union.

Comments